At the turn of the century, sporting events on the Internet were a rarity. The term streaming had barely been introduced into the American lexicon. Netflix was a mail-order business. Smart TVs with a plethora of apps weren’t mainstream. Games were broadcast exclusively on television. Newspapers were the most reliable source of written content yet their websites were still rudimentary at best. For that time being in the not-so-distant past, sports media consumption has certainly morphed into a world of its own. It would have been impossible back then to imagine what sports on the Internet would look like today.

The recruiting services timeline

In 2001 Rivals was born. In the same year, Scout.com opened its doors. Then ESPN came to the table and introduced its own recruiting department in 2003. In ’10, the founder of Rivals split to form another similar site: 247Sports.com. 2017 saw the merger of 247 with Scout. The most recent company into the recruiting space is On3 which debuted in ’21. That brings us current with the 4 major recruiting sites. All these sites analyze, evaluate, and rate players and teams a little differently.

However, the only site amongst the ‘Big 4’ that delves into the world of NIL valuations for players is On3. They deliver news, analysis, data, and insight to fans, athletes, schools, and brands. The company helps connect these communities across the college sports landscape. They assist athletes to make more informed decisions while at the same time aiding schools and brands to better manage their resources.

On3 empowers athletes to make the best NIL decisions

One of the most controversial and misunderstood concepts in the NIL era is the athlete’s value. On3 allows athletes to glimpse into their perceived value. Through a comparative tool in the On3 database players can see the change in their roster value based on a particular school they attend.

In this article, I am going to use Dylan Raiola as my example since he is at the forefront of all Husker fans at the moment. It has been widely reported that the 5 Star QB out of Chandler, AZ is currently looking at USC, Oregon, Georgia, & Nebraska. Raiola is going to have a different NIL value at each of those universities. The $249K is based upon him being uncommitted.

The easiest way to explain this complex process is to work backward so I’m going to start by summarizing Raiola and then I will go back and explain what all those foreign terms mean. The PIE score helps set Roster Value and Brand Value. Simply add those two together to come up with his (PAV) Projected Annual Value which in Dylan’s case is $249,000. Simple enough. Think again.

What is the PIE score?

For each athlete, the On3 NIL valuation algorithm takes into account three primary factors: performance, influence, and exposure to create their PIE score.

- Performance: Performance is determined by how the athlete performs on the field. Big games against key opponents, becoming nationally ranked, and winning national awards will have the most impact on an athlete’s valuation. Participation in college sports is weighted heavier in most cases than those that participate at the high school level. A few exceptions are Bronny James and Arch Manning. Last names matter.

- Influence: Influence is determined by the athlete’s own social media authority. Social media followers on Twitter, Instagram, YouTube, & TicTok are the primary factors that determine influence. Here is a snapshot of Heisman Trophy winner Caleb Williams.

- Exposure: Exposure is determined by several factors including whether the athlete is in high school or college, which school the athlete attends, and their position. Athletes that attend universities with a larger fan base and media attention are likely to see a positive impact on valuation. Athletes who play a position with higher visibility (ie. quarterback vs. center) are likely to see a higher valuation.

The Projected Annual Valuation (PAV) is a public figure. PIE ratings along with the athlete’s personal Brand Value Index and Roster Value Index are available ONLY to the athlete. That’s why you see the paddle lock icon on the Raiola screenshot above.

Brand Value & Roster Value

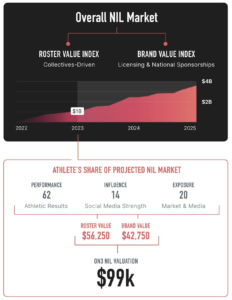

The On3 NIL valuation process establishes the overall NIL market and projects growth rate by measuring two categories, Brand Value Index and Roster Value Index. This algorithm doesn’t set an athlete’s NIL valuation for their entire career. Rather calculations are projects out to as far as 12 months into the future but no further.

The Roster Value Index collects data from all school Collectives. It’s a calculation of an athlete’s respective value to their team. It is the amount an athlete hopes to receive primarily through a school’s collective, from sources such as camps, appearances, local businesses, licensing, memorabilia, commercials, etc. This is where the 1890 Initiative or the Big Red Collective comes into play. An example of this is the Decoldest Crawford commercial for SOS Heating and Cooling.

The Brand Value Index measures the national licensing and sponsorship market. Brand Value is generated when an athlete’s Performance, Influence, and Exposure create awareness on a regional and national scale. Thus its creates advertising and sponsorship opportunities beyond Roster Value. Brand Value revenue originates from the athlete’s network and is not sourced from collectives/schools. USC WR Jordan Addison got a reportedly $3 million sponsorship through an airline company as an enticement to come play in LA.

Brand Value and Roster Value establish the overall NIL marketplace. Athletes participate based on their individual Brand and Roster Values as a starting point. Once again since Brand and Roster Values are only available to the athlete I will use John Smith screenshot below as an example. We’ve already learned the PIE score factors into Roster and Brand Value. Once those are determined the next step is to sum the two values to find the (PAV) Projected Annual Value. In this case, John Smith has a $99,000 valuation projecting out for the next year. $56,250 + $42,750… Once again these two figures are private but the $99,000 is public.

Projected Overall NIL Market

The last variable is the overall NIL market size. The marketplace is currently estimated at $750M-$1B and predicted to grow into a $3-$5B industry within the next five years. Much of this growth is expected in group licensing and branding. In parallel, the collective market size will grow as they become more integrated with school fundraising activities.

Valuations can change by the week

Individual collective size can impact an athlete’s NIL Valuation from week to week. Other factors such as PIE scores, verified deals, and changes in the overall NIL market size can affect the valuation. An athlete can see a significant change in their influence and exposure ratings through their social media accounts, which makes an immediate impact on their overall valuation.

But player performance will always lead to the biggest increase in valuation. Especially in a nationally televised game. Another factor is the impact of being nationally ranked at your position. Athletes who constantly market themself and get deals will see a jump in their valuation. On the bright side, not everyone needs to be the top athlete in their sport to generate NIL income.

Collectives are factored in valuations

On3 has created a separate roster management algorithm, which takes data from collectives, tiers the athletes based on their performance, and calculates their respective roster value at the school they are currently attending.

On3 has taken over the NIL valuation space and is the industry’s leading index that sets high school and college athletes’ projected annual value. So there you have it. The A B C’s of NIL player valuation.